Date of Withdrawal: 16-Nov-2013

Plan No. 811

- ‘LIC’s Flexi Plus’ is a special unit linked plan which targets to protect your dreams and provides an envelope of security to your family. The benefits on maturity date are guaranteed - with or without you.

- Flexibility to choose the policy term.

- Flexibility to choose the premium paying mode from yearly, half-yearly, quarterly or monthly (through ECS mode only) intervals over the term of the policy.

- Flexibility to choose from 2 fund types (Debt & Mixed) to suit your investment needs.

- Flexibility of partial withdrawals to meet your emergency needs at any time after fifth policy anniversary.

- Flexibility to surrender after completion of 5 years with no surrender charge.

- Flexibility to switch fund from one to another. Within a given policy year 4 switches will be allowed free of charge.

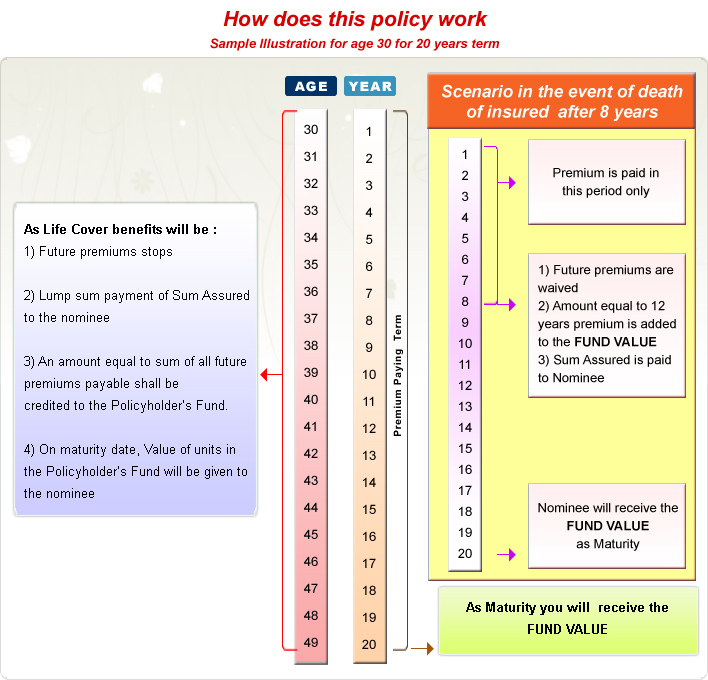

- On death of the policyholder

- Sum Assured as a lump sum to the nominee.

- An amount equal to the future premium payable is credited to the Fund.

- On Maturity Date the accumulated Policy Fund Value will be paid to the Nominee.

- On Maturity: The policyholder will get amount equal to the Fund value of the units.

- Enjoy tax benefit under section 80CCE.

| Eligibility Criteria |

|

Min. |

Max. |

| Age |

18 |

50 |

| Term |

10 |

20 |

| Sum |

150000 |

2100000 |

| Premium Modes |

Yly,Hly,Qly,Mly |

| Yearly Premium for 10,00,000 Sum Assured |

| As it is Ulip Plan the Premium is decided by the Client. |