Date of Withdrawal: 24-Nov-2013

Plan No. 805

- Bima Account I is a without profit Variable Insurance Product wherein the proposals are accepted without medical examination.

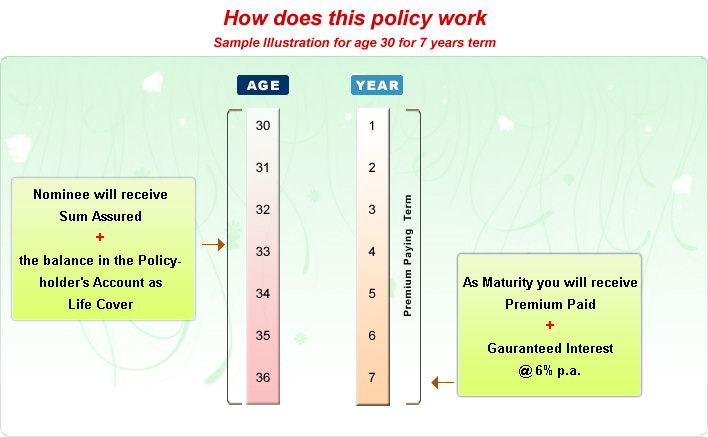

- Life Cover: The Sum Assured and the balance in the Policyholder’s Account payable to nominee.

- On maturity: An amount equal to balance in the Policyholder’s Account is payable.

- Account maintained are of two types

- Regular Premium Account - Regular premium paid will be subject to deduction of charges. The balance premium, net of charges, credited to Regular Premium Account.

- Top up Premium Account - Very Minor charges are deducted from this account compared to Regular Premium Account.

- Guaranteed annual interest of 6% p.a. for inforce policy and 5% p.a. if the policy is paidup (for the whole of the policy term).

- An additional interest rate for inforce policies may be declared. The guaranteed interest payable is on net premium.

- Expense Charge, Mortality Charge, Service tax charge and Alteration Charge will be deducted every month from the Policyholder’s Regular Premium Account appropriately (NOT from the top up account).

| Eligibility Criteria |

|

Min. |

Max. |

| Age |

11 |

50 |

| Term |

5 |

7 |

| Sum |

70000 |

280000 |

| Premium Modes |

Yly,Hly,Qly,Mly |

| Yearly Premium for 10000 Sum Assured |

| Age |

Min SA |

Max SA |

| Up to 35 |

100000 |

100000 |

| 36-45 |

100000 |

140000 |

| 46-50 |

100000 |

100000 |