Date of Withdrawal: 01-Jan-2014

Plan No. 91

- Most Ideal LIFE COVER for People with fluctuating Income

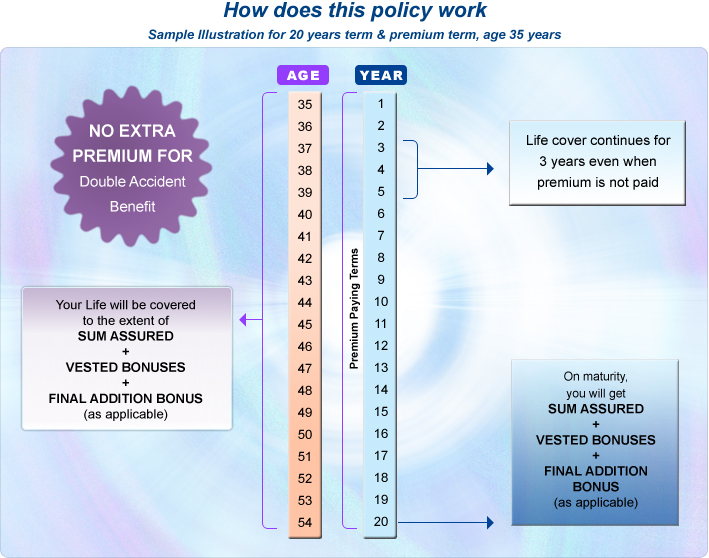

- FLEXIBLE as life cover continues for 3 years even if Premium Payment is stopped after 2 years

- Very Economical as NO EXTRA PREMIUM is charged for Double Accident Benefit which comes as FREE

- LIFE COVER - Sum Assured + Bonus + Final Addition Bonus (as applicable)

- MATURITY - Sum Assured + Bonus + Final Addition Bonus (as applicable) will be paid

- WIDE CHOICE OF TERM - can be easily aligned with your family objectives

- LIQUIDITY - You have an option to surrender the policy & receive the cash value after payment of premiums for 3 years. Loan is also available on this policy when it acquires surrender value

- Premiums paid are TAX EXEMPTED u/s 80 C

- Maturity amount is TAX FREE u/s 10 (10) (D)

- Optional Add on Riders available:

- Term Rider - to increase the Life Cover

- Critical Illness Rider – Pays the sum assured under this rider on occurrence of any critical illness. Wide list of illnesses are covered.

| Eligibility Criteria |

|

Min. |

Max. |

| Age |

18 |

50 |

| Term |

12 |

30 |

| Sum |

50,000 |

1000000 |

| Premium Modes |

Yly, Hly, Qly, Mly, SSS |

| Yearly Premium for 10,00,000 Sum Assured |

| Age |

15 |

20 |

25 |

| 25 |

67840 |

49022 |

38594 |

| 30 |

68422 |

49798 |

39613 |

| 35 |

69634 |

51301 |

41456 |

| 40 |

71720 |

53872 |

44560 |