Date of Withdrawal: 29-Dec-2013

Plan No. 133

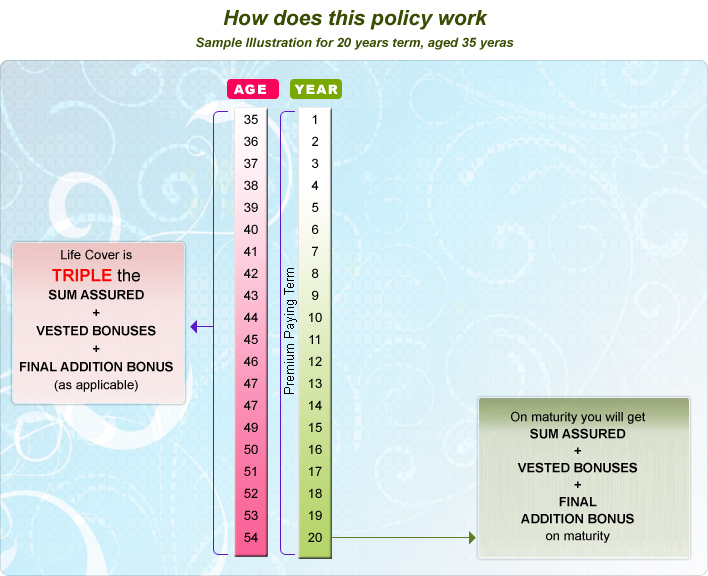

- Triple benefit endowment plan that provide a new dimension to the concept of insurance security. High security at very low cost

- Jeevan Mitra not only helps to make provisions for the family of the Life Assured in the event of his early death, but also assures a lump sum at the desired age.

- For a small extra cost over conventional endowment plan, it offers riskcover which is 3 times the basic sum assured + bonus

- WIDE CHOICE OF TERM - can be easily aligned with your family objectives

- LIQUIDITY - You have an option to surrender the policy & receive the cash value after payment of premiums for 3 years

- MATURITY - Sum Assured + Bonus + Final Addition Bonus (as applicable) will be paid.

- Premiums paid are TAX EXEMPTED u/s 80 C

- Maturity amount is TAX FREE u/s 10 (10) (D).

- Optional Add on Riders:

- Double Accident Benefit (DAB) – four times the sum assured is paid in case of death due to accident

- Critical Illness Rider – Pays the sum assured under this rider on occurrence of any critical illness. Wide list of illnesses are covered. There is also a Premium Waiver option in case the critical illness claim is made

| Eligibility Criteria |

|

Min. |

Max. |

| Age |

18 |

50 |

| Term |

15 |

30 |

| Sum |

50,000 |

No limit |

| Premium Modes |

Yly, Hly, Qly, Mly, SSS |

| Yearly Premium for 10,00,000 Sum Assured |

| Age |

15 Years |

20 Years |

25 Years |

| 18 |

68616 |

49992 |

39855 |

| 20 |

68810 |

50283 |

40340 |

| 22 |

69052 |

50768 |

41019 |